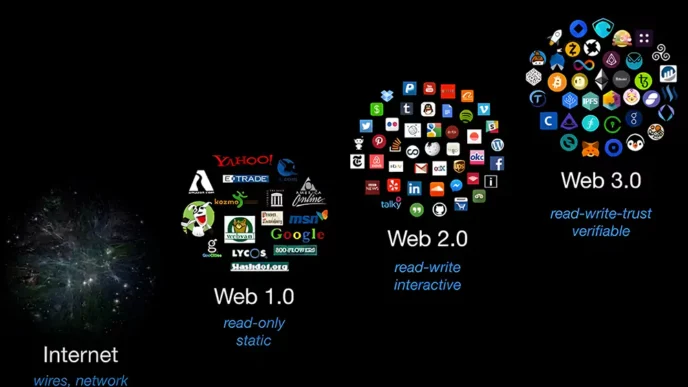

In many crypto gatherings, the discussion has centered on Fundamental Analysis, the use cases of crypto, and its prospects. In recent times, cryptocurrencies have been rallying—and it’s completely unlike anything we have seen before. A section of investment experts have called it a bubble. Yet this so-called bubble has defied the odds. The crypto industry continues to grow faster than traditional finance.

To be successful in crypto trading, one must understand what fuels the market. This article explores the fundamentals of crypto analysis, from the tech behind the coin to market demand and beyond. Find out what counts when assessing cryptocurrencies.

Seeking Maximum Returns

In bull markets, investors are hungry to find opportunities with the potential to gain massive returns. One of the strategies investors and traders adopt is Fundamental Analysis (FA). We use analysis to determine the potential of projects. The alternative is Technical Analysis.

Whereas TA looks into chart patterns and short-term price movements, FA looks into projects’ intrinsic value and capacity to prosper in the long run.

What is Fundamental Analysis?

Fundamental Analysis involves digging beneath the surface of crypto to see what really drives its value. Simply measuring a single factor is insufficient. It is important to take the time to assess various factors to determine the inherent worth of digital assets. This becomes more critical from a long-term investment perspective.

So, how is this different from technical analysis? The Fundamental Analysis explores the ‘why’ a cryptocurrency will potentially succeed, and technical analysis hunts down the ‘when’. Market patterns and price movements—these basics are how technical analysis works. According to historical data, it tells you when is the best time to enter or exit the market.

Cryptocurrency values: With Fundamental Analysis, we evaluate the value seeded within cryptocurrencies. Many factors affect FA, such as project utility, tokenomics, the team in place, social traction, regulatory risk, and on-chain data. Unlike Technical Analysis, where professionals analyze the trading volume, candlestick patterns, and price action to forecast short-term market movements, this approach is completely different.

How to Conduct Fundamental Analysis

The process of FA involves several key areas:

Tokenomics: When we consider tokenomics in Fundamental Analysis, we evaluate token utility, fully diluted valuation (FDV), total value locked (TVL), revenue, and market capitalization (MC). Tokenomics is concerned with the economics of the token. How does the project manage supply? Is there a limited total number of tokens, or is it inflationary? Find out the token distribution strategy. How many tokens do the team get?

How does the team distribute tokens among developers, the team, and the community? The distribution is what decides the token’s value and susceptibility to manipulation. Evaluate how inflation or deflation occurs. Can a burning or staking mechanism affect supply?

Your starting point is the whitepaper. This is where you will find the vision of the project, your goals, all the technology details. Does it solve a real problem? Is it feasible?

Project Team: When considering the team, you want to know who’s behind the cryptocurrency. Determine whether or not the team is an expert in the task they are embarking upon. A project that has a strong team behind it can be a sign of credibility and of the potential for a successful project. See how their development is going. Do they work on the project? Always visit projects that frequently update and engage with their communities. If there are no updated posts within 7 days or a week at times, then steer clear. This is probably the best measure for assessing a project.

Funding and financial health: Find out how the project is funded. Who else has backed this idea with money from reputable investors or organizations? Investors provide early money to a project, signaling its credibility and a sense that savvy investors have substantial faith in the project’s possible future. Look at how the project will be making money. The project explains how it will create revenue and its model for becoming financially sustainable. If there’s no obvious revenue path to that project, it’s going to flounder over time.

Social Traction: Check their social media presence and community engagement. Is it only a few people commenting while there are thousands of followers?

Regulatory Risks: Considering the potential impact of regulatory changes.

On-Chain Analysis: Today, it is easy to analyze on-chain activity with the tools at your disposal. This can help to gauge the project’s health and adoption rate.

Technology and Use Cases: Ask which blockchain and why? What’s under the hood? Assess the technology in terms of it’s scalability, security and innovation. There are no correct answers, but this informs how the team is thinking about the project.

So, is it just another blockchain, or does it provide something new? Is this cryptocurrency the answer to a big problem? Will it break existing systems or industries or improve them? These factors are crucial for investors aiming for long-term investment strategies, as they provide a comprehensive view of a project’s potential for success.

Why Fundamental Analysis?

Fundamental Analysis is used by investors to select projects with high potential for long term value appreciation. The project’s adoption level — institutional or retail — often determines whether it will be successful. When adoption increases, it raises demand and subsequently prices.

The Journey of Fundamental Analysis

Analysts will begin by examining the utility of the project and the problem it solves. It includes the evaluation of tokenomics to understand supply dynamics, inflation rates and token allocation. This analysis also includes a critical analysis of the market cap versus Fully Diluted Value, Total Value Locked, and the project’s overall capitalization.

In addition, they take account of each of the project’s digital footprints – their website, their team’s credentials, their social media engagement, and their regulatory status. Finally, the project’s financial health, with a focus on its capabilities in generating revenue and on chain activity are assessed to ensure the project is truly viable.

Tools for Fundamental Analysis

Several tools can help investors in conducting Fundamental A. Some of them are listed below:

Nansen, Glassnode, and Crypto Quant: For on-chain analytics.

IntoTheBlock and Token Terminal: For in-depth project metrics.

DeFiLlama: Essential for evaluating TVL and other DeFi-specific metrics.CoinGecko and CoinMarketCap: For market data and token information.