Bitcoin’s price has just surged to new heights, and experts believe BlackRock’s historic Bitcoin ETF launch could send the cryptocurrency soaring to an unprecedented $200,000.

In a stunning turn of events, Bitcoin has skyrocketed to over $94,000, marking a 150% increase from this time last year. The catalyst? BlackRock’s monumental launch of a spot Bitcoin exchange-traded fund (ETF) that is already generating a massive wave of trading activity. This surge comes just after the ETF’s first day of options trading, where nearly $1.9 billion in notional value exchanged hands—an unheard-of figure that has left markets buzzing.

BlackRock’s Role in Bitcoin’s Surge

As the world’s largest asset manager, BlackRock’s involvement in Bitcoin is nothing short of revolutionary. Their $42 billion Bitcoin fund has been a major factor in driving Bitcoin’s recent bull run. In fact, the ETF has quickly become one of the fastest-growing in history, signaling a new era of institutional interest in digital assets.

On the heels of this groundbreaking launch, Tesla’s Elon Musk also threw his weight behind crypto, issuing a surprise endorsement that sent shockwaves through the market. Musk’s influence, combined with BlackRock’s game-changing ETF, has contributed to a perfect storm for Bitcoin’s explosive rise.

Bitcoin set for $200K ?

With Bitcoin hitting record prices, analysts are now predicting that a “tipping point” could be approaching—a threshold that could send Bitcoin to a staggering $200,000 by 2025. This prediction follows remarks from Bloomberg Intelligence’s Eric Balchunas, who stated that the sheer volume of trading in Bitcoin ETFs could trigger a new wave of mainstream adoption. Balchunas noted that the ETF’s volume could soon convince financial advisors that avoiding Bitcoin might be a risk to their careers.

As BlackRock’s Bitcoin ETF reaches new milestones, market participants are grappling with the idea that the momentum surrounding Bitcoin could soon become self-sustaining. With more institutional players entering the space, the question is no longer “if” Bitcoin will continue to rise, but rather “how high” it will go.

Why This Matters: The Web3 Revolution Is Here

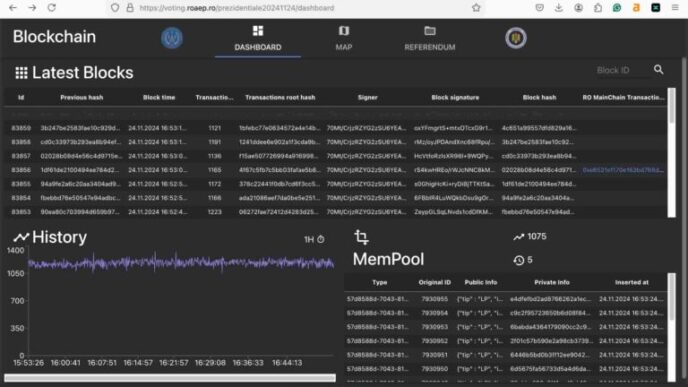

Bitcoin’s journey to $200,000 is not just about price—it’s about the evolution of finance itself. As more traditional institutions, including BlackRock and Tesla, embrace Bitcoin, the foundation for Web3 is solidifying. Web3 represents the next era of the internet, where decentralized finance (DeFi) and blockchain technology could reshape everything from payments to ownership.

With Bitcoin as the flagship of this revolution, its price surge is more than a financial event—it’s a glimpse into the future of money, investment, and the global economy. As the tipping point draws closer, the world’s financial system is on the brink of a transformation that could see Bitcoin not just as a speculative asset, but as an integral part of the new global financial infrastructure.

For crypto enthusiasts, investors, and anyone keeping an eye on the future of digital assets, this moment is undeniably thrilling. The combination of BlackRock’s institutional backing, the explosion in ETF trading, and Musk’s endorsement all point to one undeniable conclusion: Bitcoin is no longer a fringe asset—it’s a force that could redefine wealth in the 21st century.

Is $200,000 within reach? Time will tell. But one thing is clear: the tipping point for Bitcoin is rapidly approaching, and the ride is just beginning.